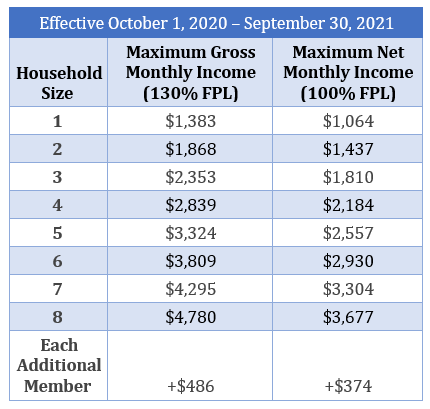

Another major issue with government assistance is that the cutoff points for recipients tend to be at an inadequate level for those who intend to have a healthy, standard lifestyle.[1] For example, in D.C, to qualify for SNAP benefits, applicants must have the following monthly income:[2]

Although these cut-offs are meant to assist individuals in these particular income brackets, this doesn’t cover individuals who make above these means, but still can’t afford basic needs. For instance, 2019 study found that the median D.C. household should devote no more than $3,100 a month or roughly $34.48 an hour for rent on a two-bedroom apartment to be financially secure.[3] Thus, a household of two people making $2,000 a month collectively would still struggle to pay rent and obtain their bare necessities. Even more pressing, sudden shifts in minimum wage could impact a family’s monthly income drastically.[4] The result of loss of benefits like SNAP can be severe, resulting in food insecurity, which, in turn, is associated with other negative outcomes.[5] For instance, in children, food insecurity is associated with increased health problems, delayed development, decreased academic achievement, and decreased lifelong economic outcomes.[6] In 2018, 25% of New York State food insecure residents had estimated incomes above SNAP eligibility.[7] Ultimately, in D.C., as in many states across the country, benefit calculations are not an accurate depiction of costs of living.

To reduce the impacts of the benefits cliff, some states changed what factors are considered in the analysis of whether an individual is eligible for assets, such as by excluding vehicle assets from consideration.[8] Other states have ignore child support collected by the state in determining eligibility.[9] These incremental changes may be helpful, but for long-term effects, states should consider other means to mitigate the benefits cliff.

[1] See Stephanie Ettinger de Cuba et al. Punishing Hard Work: The Unintended Consequences of Cutting SNAP Benefits, (2013),http://www.childrenshealthwatch.org/wp-content/uploads/cliffeffect_report_dec2013.pdf;

[2]Dep’t of Hum. Services,, SNAP Eligibility: General Requirements

https://dhs.dc.gov/service/snap-eligibility-general-requirements

[3] Marissa Lang, Want to rent in D.C. without being ‘cost-burdened’? A household needs $132,857 a year, report says: The city’s median household income, according to the study, hovers around $82,000, Washington Post (July 31, 2019), https://www.washingtonpost.com/local/want-to-rent-in-dc-without-being-cost-burdened-a-household-needs-132857-a-year-report-says/2019/07/31/897ed0c8-b2f2-11e9-8f6c-7828e68cb15f_story.html; See also Marissa Lang, D.C. residents must earn $34.48 an hour to afford a two-bedroom home, report says, (Jun. 20, 2018), https://www.washingtonpost.com/news/local/wp/2018/06/20/d-c-residents-must-earn-34-48-an-hour-to-afford-a-two-bedroom-home-report-says/

[4] See Robert Farrington, The Benefits Cliff: When a Higher Minimum Wage Results in Lost Benefits, Forbes (Apr. 5, 2021, 10:30 AM), https://www.forbes.com/sites/robertfarrington/2021/04/05/the-benefits-cliff-when-a-higher-minimum-wage-results-in-lost-benefits/?sh=2cbdb628a033

[5] Elaine Waxman &Nathan Joo, How Household with Children Are Affected by Restricting Broad-Based Categorical Eligibility for SNAP, 5, (Sep. 2019), https://www.urban.org/sites/default/files/publication/101029/how_households_with_children_are_affected_by_restricting_broad-based_categorical_eligibility_for_snap_1.pdf?ftag=MSFd61514f

[6] Id.

[7] FWPA, Pushed to the Precipice: How Benefits Cliffs and Financial Gaps Undermine the Safety Net for

New Yorkers, 40, (Apr. 2021), https://www.fpwa.org/wp-content/uploads/2021/04/2104019_FPWA-benefitcliffs-rev2_FINAL_4.19.2021.pdf

[8] Pedro Perez, Examining, understanding, and mitigating the benefits cliff effect, aha! Process Inc. (May 21, 2018), https://www.ahaprocess.com/examining-understanding-and-mitigating-the-benefits-cliff-effect/; See also National Conference of State Legislatures, State Policies to Counteract the Cliff Effect in Public Programs,2, (Oct., 2011), https://www.legis.nd.gov/files/committees/64-2014%20appendices/17_9066_01000appendixb.pdf

[9] See id.